Ever dreamed of owning your own business? I know I have! Most people are very attracted to the idea of being their own boss.

While owning a small business is an appealing idea, it does carry some significant risks. Only 50 percent of small businesses actually survive the first five years. That’s a scary thought.

Financial Planning Tips for Small Business Owners

So, what helps those 50 percent survive? Success depends on budgeting properly, finding the right product/service for your market, marketing that product correctly, and then selling the correct volume of your product/service.

Often, small business owners don’t realize that they need to change their individual financial plans to account for the risks and realities of owning a small business.

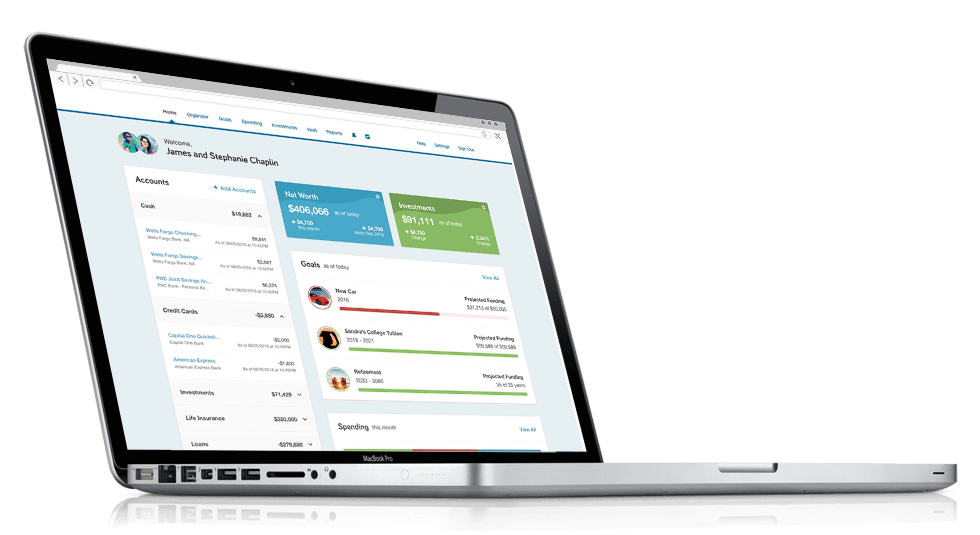

Financial planning for an individual usually involves investment planning, tax planning, retirement planning, estate planning and risk management. Let’s discuss how owning a small business affects these.

Investment Planning

The majority of small business owners self-finance their company. It becomes their only investment. As the business grows and the owner has more capital, he ends up putting that money back into the company instead of investing elsewhere.

This seems like the logical thing to do; however, good planning should include diversification. Having all your money tied up in one business can be results in a very concentrated risk. Therefore, other investments and assets should be chosen carefully to help balance this risk. “Don’t put all of your eggs in one basket” is a saying that applies here.

Tax Planning

Recent legislation has changed the way businesses treat various legal structures. After a 205 deduction, income attributed to a sole proprietorship as well as business income given to an individual through a pass-through entity will be taxed at individual tax rates.

[Related: New Tax Laws for 2018]

Individuals and businesses can have different marginal rates, at different tax brackets. However, it is possible to coordinate the taxation of personal income and business income in a way that is beneficial to both the owner and the business.

Risk Management

Individuals need to plan for the risk of disability, illness and infirmity, liability and loss related to property ownership, and early death. Owning a business increases these financial risks to include: loss of business property, lawsuits from negligence or product defects, interruption of business due to disaster, and death or disability of a key person in the company.

[Related: Executive Planning]

Lawsuit risks need to be handled by the legal structure of the business, but the other risks will require a specialized insurance coverage. Also, when the business has employees, workers compensation coverage is a necessity.

Retirement Planning

Some business owners think of the business as their retirement plan, and others just don’t plan to ever retire. Both mind frames are flawed.

Business owners should always prepare for a time when they can’t, or don’t want, to work anymore because the business may not be able to fully supply the owner’s financial needs.

Fortunately, business ownership comes with various tax-advantaged ways to save and plan for retirement as well as the ability to put aside much larger amounts than what is allowed for non-business owners.

Estate Planning

As the business grows and becomes a larger, more valuable assets, more in-depth planning is required to ensure the business continues after death. Planning can also help reduce the amount taxes required during a transfer and help provide liquidity to heirs to cover the costs of those taxes.

In some cases, it is advised to reorganize the business and create different types of ownership for family members. This option also allows you to take advantage of IRS- sanctioned discounts in valuing the business for estate and gift tax purposes. Charitable trusts or insurance trusts can also ease the transfer of a small business.

You built your business from the ground up and probably think that you don’t need anyone to tell you how to run it. However, it is extremely important to consider the use of a professional when it comes to managing the financial issues involved in owning a business.

If you are ready to secure the future of your business, contact Blisk Financial Group today and schedule your consultation.